nassau county sales tax rate 2020

This is the total of state and county sales tax rates. Taxing jurisdiction Tax rate Sales Tax Information Center.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc.

. On January 1 2020 the state tax rate was reduced from 57 o 55. Nassau county sales tax rate 2020 Tuesday March 15 2022 Edit The exact property tax levied depends on the county in Virginia the property is located in. On February 15 th.

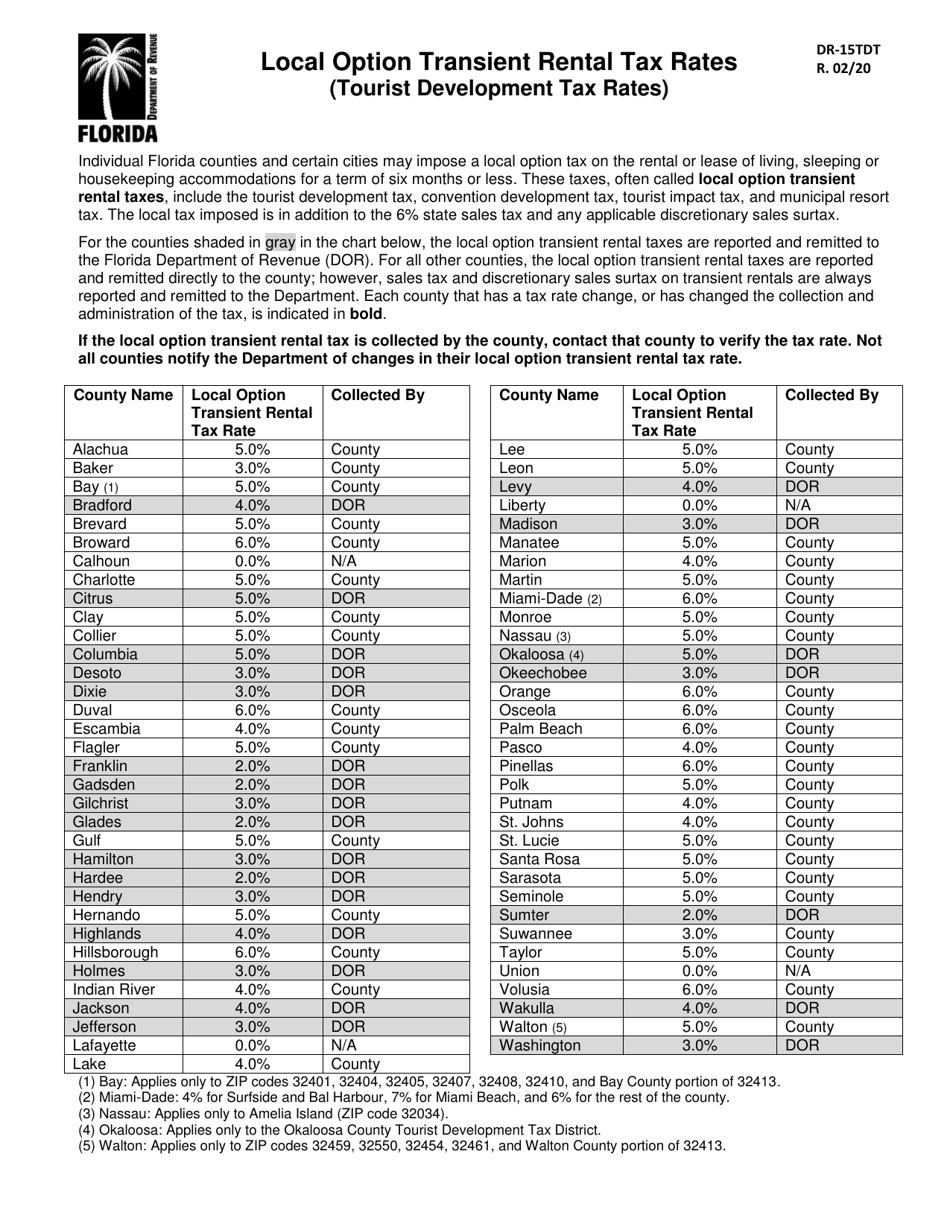

The Sales Tax rate for Nassau County is 865. 72 rows The plan has been to slowly but surely reduce the sales tax rate on commercial rent to zero and weve seen reductions in the tax rate for several years now. Total State and Local Sales Tax Rate by County as of January 1 2020 Source.

This consists of three components. 74 rows The local sales tax rate in Nassau County is 0 and the maximum rate including. The combined rates vary in each county and in cities that impose.

The Nassau County Sales Tax is collected by the merchant on all qualifying sales made within Nassau County. State Local Sales Tax Rates As of January 1 2020. Fast Easy Tax Solutions.

518-485-2889 To order forms and publications. How much is NY Sales Tax 2020. The 2018 United States Supreme Court decision in South Dakota v.

The Nassau County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Nassau County local sales taxesThe local sales tax consists of a 100 county sales tax. New York State Department of Taxation and Finance Tax and Finance Notes. In early December 2020 Nassau County Executive Laura Curran announced a market value freeze for the 20222023 tax year.

Groceries are exempt from the Nassau County and Florida state sales taxes. Nassau County Annual Tax Lien Sale - 2022. However most people will pay more than 55 because commercial rent is also subject to the local surtaxes at a rate where.

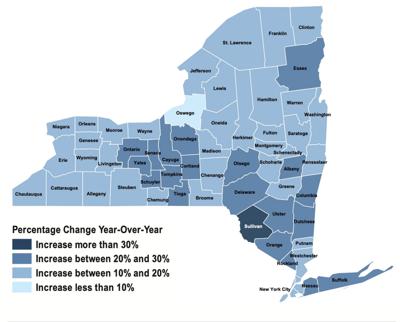

Amid the COVID-19 pandemic sales tax revenue in Nassau County could drop 12 percent to 28 percent officials said Monday. The local sales tax rate in Nassau County is 1 and the maximum rate including Florida and city sales taxes is 75 as of April 2022. These rates are weighted by population to compute an average local tax rate.

Download all New York sales tax rates by zip code. 425 which is forwarded to the County of which 25 is. Ad This is the newest place to search delivering top results from across the web.

518-457-5431 Text Telephone TTY or TDD Dial 7-1-1 for the equipment users New York Relay Service. B Three states levy mandatory statewide local add-on sales taxes at the state level. How much is NY Sales Tax 2020.

The December 2020 total local sales tax rate was also 8625. Ad Find Out Sales Tax Rates For Free. Nassau County NY Sales Tax Rate The current total local sales tax rate in Nassau County NY is 8625.

Thats according to Jack. The New York state sales tax rate is currently 4. As your County Executive I will continue to work hard to provide.

The Nassau County Sales Tax. Content updated daily for sales tax rate in nassau county. 375 is earmarked for the Metropolitan Transportation Authority.

California applies its highest tax rate to. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. An additional tax rate of 0375 percent is imposed in New York City and in Dutchess Nassau Orange Putnam Rockland Suffolk.

Nassau county sales tax rate 2020 Tuesday March 15 2022 Edit The exact property tax levied depends on the county in Virginia the property is located in. Each years unpaid taxes will be sold separately so for example if a parcel has unpaid 2020 School andor General taxes. The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use Tax of 8875 percent.

Due to the postponement of last years sale in response to the COVID-19 pandemic this sale will contain unpaid taxes from both 2020 and 2021 tax years. The Nassau County sales tax rate is 425. In November of 2019 the median pending sale price for a residential condominium or co-op property was 525000.

This resource is designed to provide information about your county government the many services and recreational programs we offer and different ways we can provide assistance to the more than 14 million residents who live here. Who must file Complete Form ST-1012 Annual Schedule A if you make sales or provide any of the taxable services listed below in Nassau County or. Monroe County 4 Montgomery County 4 Nassau County 4⅝.

More than 60 percent of Nassau County homeowners will pay more in School Taxes in 2020 than they did in. An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD. The minimum combined 2022 sales tax rate for Nassau County New York is 863.

The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use Tax of 8875 percent. Adina Genn May 18 2020. Contact the district representative at 409-684-6311 for additional boundary information.

Has impacted many state nexus laws and sales tax collection. Welcome to Nassau Countys official website. A City county and municipal rates vary.

California 1 Utah 125 and Virginia 1. 4 which is retained by New York State.

Florida Sales Tax Small Business Guide Truic

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

What Is New York S Sales Tax Discover The New York Sales Tax Rate In 62 Counties

How To Calculate Sales Tax For Your Online Store

File Sales Tax By County Webp Wikimedia Commons

Local Economic Acceleration Plan Leap Part Two Open Nassau

Florida Sales Tax Rates By City County 2022

Form Dr 15tdt Download Printable Pdf Or Fill Online Local Option Transient Rental Tax Rates Tourist Development Tax Rates Florida Templateroller

New York Sales Tax Rates By City County 2022

New York Sales Tax Everything You Need To Know Smartasset

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

How To Calculate Fl Sales Tax On Rent

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com